colorado electric vehicle tax credit form

We have some great news. EV Enthusiasts Featured Media Tags.

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

The credits decrease every few years from 2500 during January 2021 2023 to 2000.

. A separate form must be completed for each qualifying vehicle. Plug-In Electric Vehicle PEV Tax Credit. Please see the instructions and FYI Income 69 available online at TaxColoradogov before completing this form.

As of August 2021 the US Senate through a non-binding solution has approved a 40000 threshold on the price of electric cars that would be eligible for a 7500 federal tax credit. Many leased EVs also qualify for a credit of 2000 this. Light-duty PEVs purchased leased or converted before January 1 2026 are eligible for a tax credit equal to the amounts below per calendar year.

Use this form to calculate the innovative motor vehicle and innovative truck credit available for the purchase lease or conversion of a qualifying motor vehicle including an electric vehicle like a Tesla. The credits which began phasing out in January will expire by Jan. The tax credit is.

A Strong Foundation for EVs in Colorado. Be sure to use the form s for the same tax year for which you are filing. Ensure that you are using the correct form for your tax year.

Colorado allows an income tax credit to taxpayers who have purchased an alternative fuel vehicle converted a motor vehicle to use an alternative fuel or have replaced a vehicles power source with an alternative fuel power source. If you claim the Colorado Electric Vehicle Tax Credit for yourself you need to file a Colorado income tax return Form DR 0617 and a copy of the lease or purchase agreement. This tax credit goes down to 2500 on January 1 2021 so buy your car now to take advantage of the 4000 credit.

If you purchase or lease a Jeep Plug-in Hybrid Electric Vehicle PHEV you might be eligible for up to a 7500 federal tax credit with possible additional state incentives. Are there federal tax credits for new all-electric and plug-in hybrid vehiclesThis link will provide you an update by car manufacturer. Please visit ColoradogovTax prior to completing this form to review our publications about these credits.

Qualifying vehicle types include electric vehicles plugin hybrid electric vehicles liquefied petroleum gas LPG vehicles and compressed natural gas CNG vehicles. Chevy bolt Chevy Volt colorado electric vehicle incentives colorado electric vehicle tax credit EV ev tax credit Nisan Leaf tax credits Tesla Model 3. This form only applies to qualified electric vehicle passive activity credits from prior years allowed on Form 8582-CR or Form 8810 for the current year.

New EV and PHEV buyers can claim a 5000 credit on their income tax return. There recently have been updates to Colorados electric vehicle EV tax. You might qualify for tax credits offered by the IRS if you purchase.

Qualified PEVs titled and registered in Colorado are eligible for a tax credit. This includes all Tesla models and Bolts that do not receive the Federal tax incentive. Information on tax credits for all alternative fuel types.

Also use Form 8936 to figure your credit for certain qualified two- or three-wheeled plug-in electric vehicles. Coloradoans Have Access to Highest EV Tax Credit in Nation June 16 2017 Categories. Use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year.

The credit is worth up to 5000 for passenger vehicles and more for trucks. Colorados tax credits for EV purchases. Use this form to claim innovative motor vehicle and innovative truck credits.

Aquí nos gustaría mostrarte una descripción pero el sitio web que estás mirando no lo permite. The value of the credit depends on the technology employed and the vehicles emissions profile and has a maximum limit of 6000. The qualified electric vehicle credit was available for certain vehicles placed in service before 2007.

Right now you can get a 4000 tax credit in Colorado for the purchase or lease of ANY new all-electric vehicle and qualifying plug-in hybrid electric vehicles. The tax credit for most innovative fuel. For example if you are filing an income tax return for 2018 you must include the credit subtraction andor deduction form s for 2018 with.

For additional information consult a dealership or this Legislative Council Staff Issue Brief. As a plug-in electric vehicle PEV purchaser you are eligible for up to 7500 in Federal and 6000 in Colorado tax credits. The state offers tax incentives on new purchases of electric and plug-in hybrid vehicles.

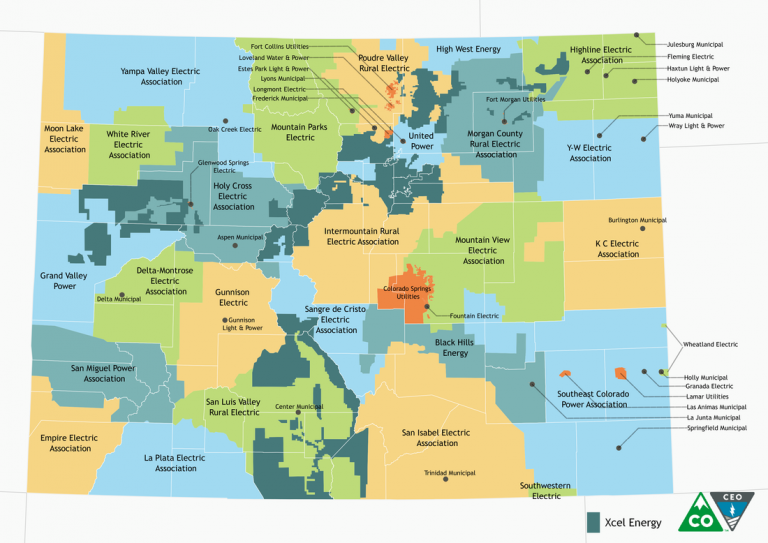

Developed in partnership with CEO CDPHE CDOT and the Regional Air Quality Council the states first Colorado Electric Vehicle Plan was issued in January 2018an updated Colorado Electric Vehicle Plan 2020 was released in April 2020. The state of Colorado also offers a tax credit for the purchase of alternative fuel vehicles including plug-in electric vehicles. An electric vehicle state tax credit from the state of colorado for the purchase of an ev and also receive an ev rebate from xcel energy for the same ev customer shall promptly return to xcel energy the difference between the ev rebate and the amount of the state tax credit received for the ev upon notice from xcel energy.

Used electric vehicles do not qualify for the Colorado Electric Vehicle Tax Credit but there are many used electric vehicles on the market that may be cheaper than new electric vehicles. The Colorado state tax credit will decrease to 2500 in 2021 and continue to decline until it is phased out entirely at the end of 2025. GET FEDERAL TAX CREDITS AND STATE INCENTIVES FOR YOUR JEEP 4xe VEHICLE.

If filing by paper use the form s listed below that correspond s with the subtraction credit or deduction you are claiming. Tax credits are available in Colorado for the purchase lease and conversion of light medium and heavy duty alternative fueled vehicles electricEV plug-in hybrid or PHEV compressed natural or CNG liquefied natural gas or LNG liquefied petroleum gas or LPG and hydrogen These credits were simplified effective Jan. Some dealers offer this at point of sale.

Now thats a bang for your buck. Federal Tax Credits for Fuel-Efficient Vehicle Owners. In Colorado drivers are eligible for a state tax credit of up to 4000 on the purchase of a new EV or Plug-in Hybrid Electric Vehicle.

Electric bicycles received their first-ever nod from the federal government in the form of a 30 tax credit of their own. Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric vehicle. Qualified electric vehicle passive activity credits allowed for your current tax.

In addition to the Colorado-specific incentives offered by the State there are a number of federal tax credits for fuel-efficient vehicle owners. Credit for Buying a Hybrid. About Form 8936 Qualified Plug-In Electric Drive Motor Vehicle Credit.

Colorado Ev Incentives Ev Connect

Eligible Vehicles For Tax Credit Drive Electric Northern Colorado

Tax Credits City Of Fort Collins

A Fleet Manager S Guide Electric Vehicle Tax Credits

Rebates And Tax Credits For Electric Vehicle Charging Stations

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

How Do Electric Car Tax Credits Work Credit Karma

Plug In Electric Vehicle Policy Center For American Progress

Ev Tax Credit Calculator Forbes Wheels

Utilities Rebates Incentives Drive Electric Colorado

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Tax Credits Drive Electric Northern Colorado

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Nys Electric Vehicle Rebate At Hoselton Auto Mall In East Rochester Ny New Pre Owned And Certified Vehicles

Don T Miss Out On Electric Car Tax Benefit Deadlines Valuepenguin

Electric Car Incentives Save Money On Your Next Electric Car